550

“More than 230,000 small businesses in Louisiana will face tax hikes if the deductions we passed in the Tax Cuts and Jobs Act expire. The Main Street Tax Certainty Act will help make sure that the backbone of America’s economy continues to provi

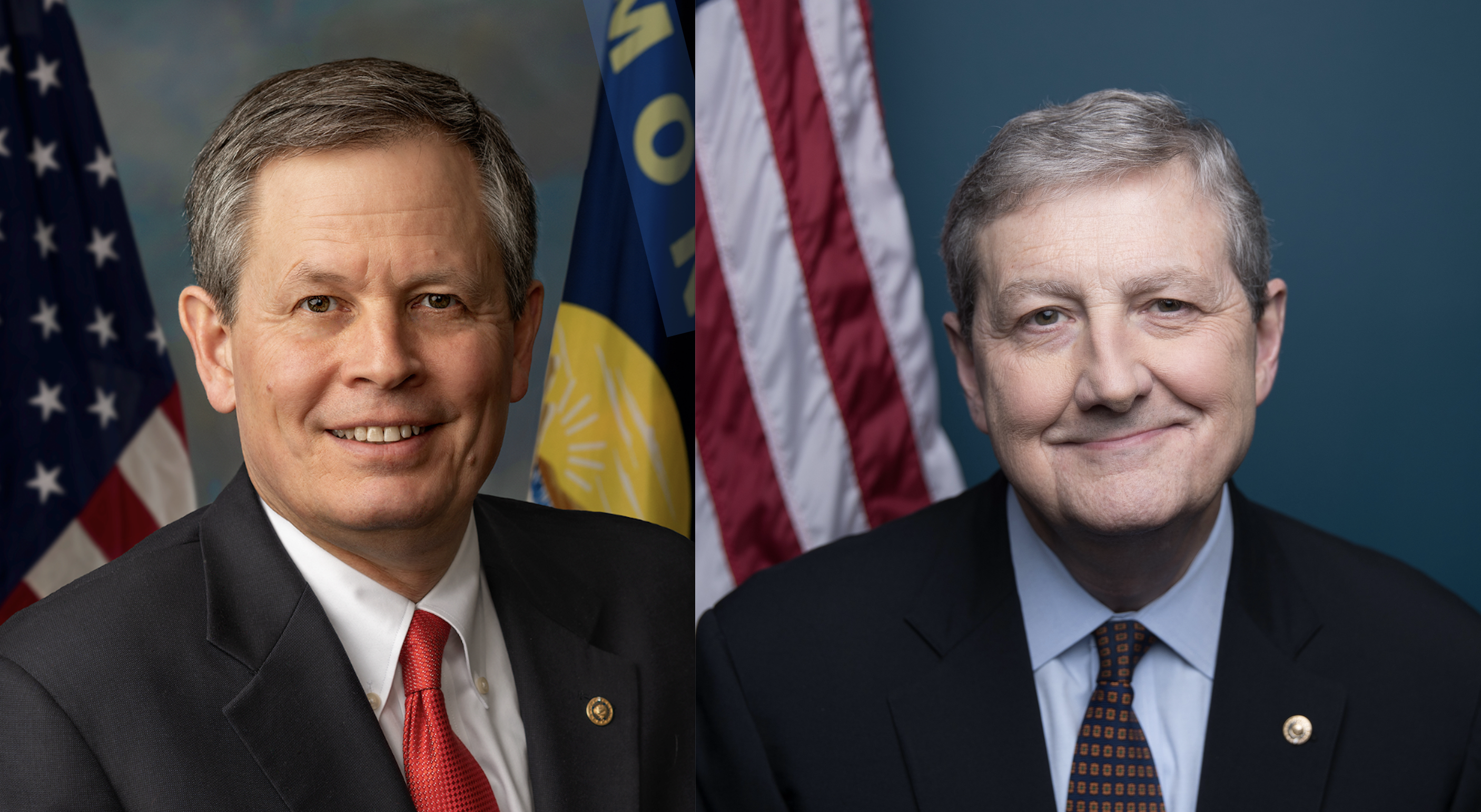

Home NewsRegional/State NewsKennedy, Daines champion bill to stop small business tax hike, protect Tax Cuts and Jobs Act deductions