299

Approval of tax assessments has been pushed back to October to await the outcome of a special election for the Road District B tax.

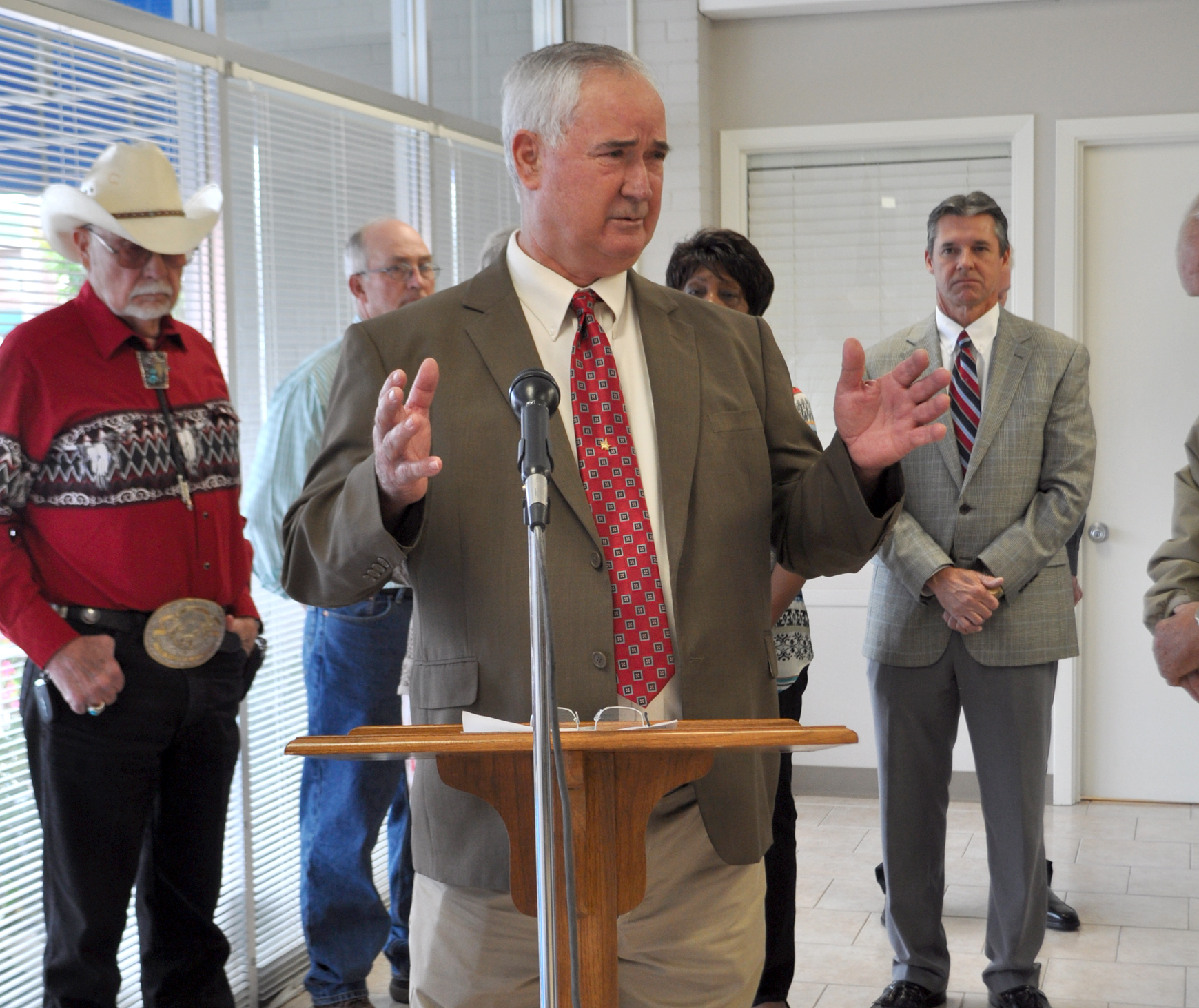

Webster Parish Tax Assessor Morris Guin said assessments are nearly complete, but they don’t have the numbers in

New parish tax assessments near complete

previous post