282

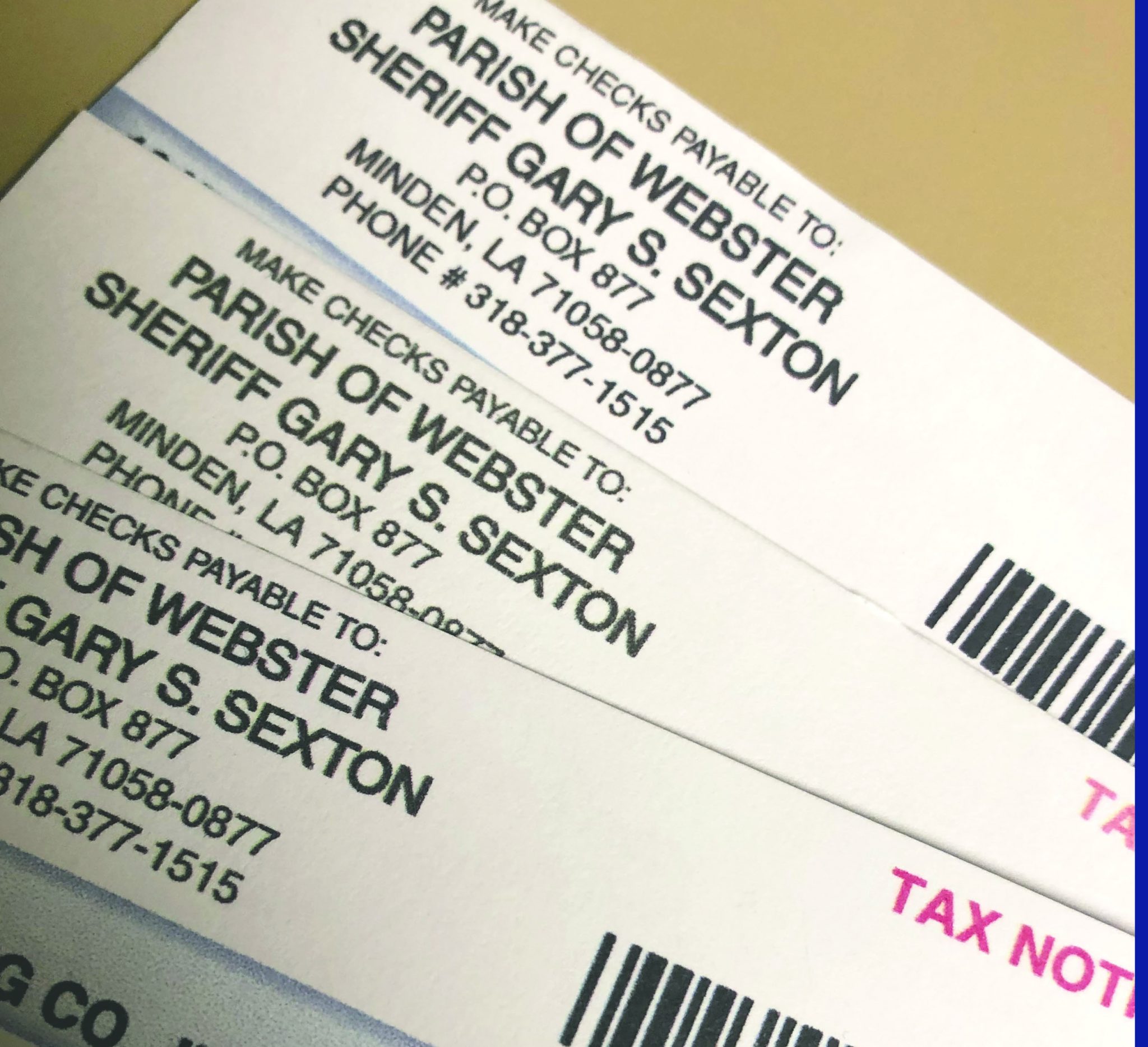

Webster Parish is in its second week of property tax collections. Property taxes are due December 31, 2018.

Tax rates on property vary throughout the parish based on millages voted on for institutions such as schools, law enforcement, fire depart

Residents receive property tax notices

previous post