362

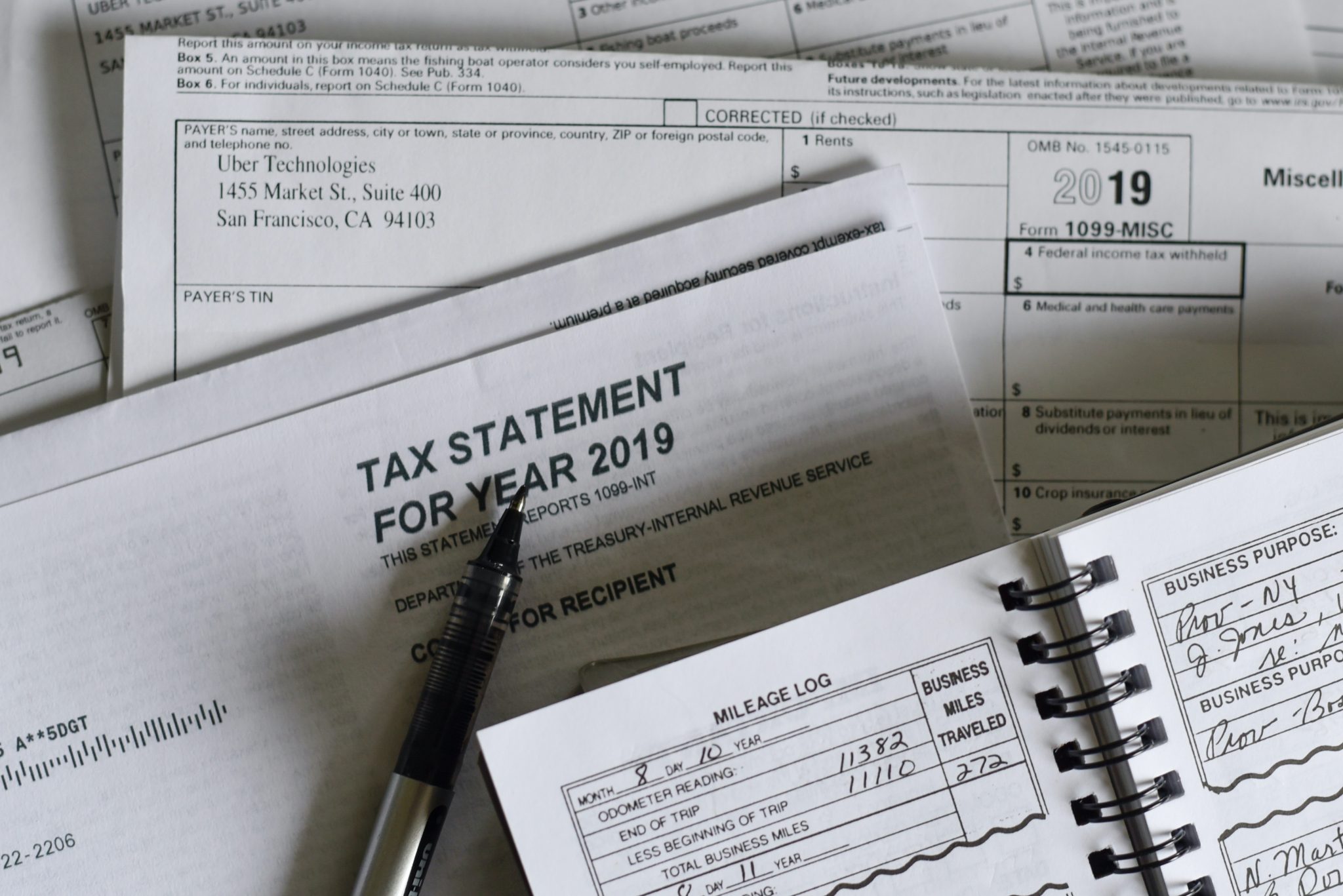

A recurring scam this filing season targets tax professionals with a spearphishing email to collect their Electronic Filing Identification Numbers (EFINs). Tax pros should be alert to this scam to protect their client data.

How the scam works

T