202

By Tryfon BoukouvidisLSU Manship School News Service

BATON ROUGE -- The House Appropriations Committee on Monday advanced a proposal on a 12-5 vote along partisan lines that would phase out the portion of the state sales tax that the Legislature

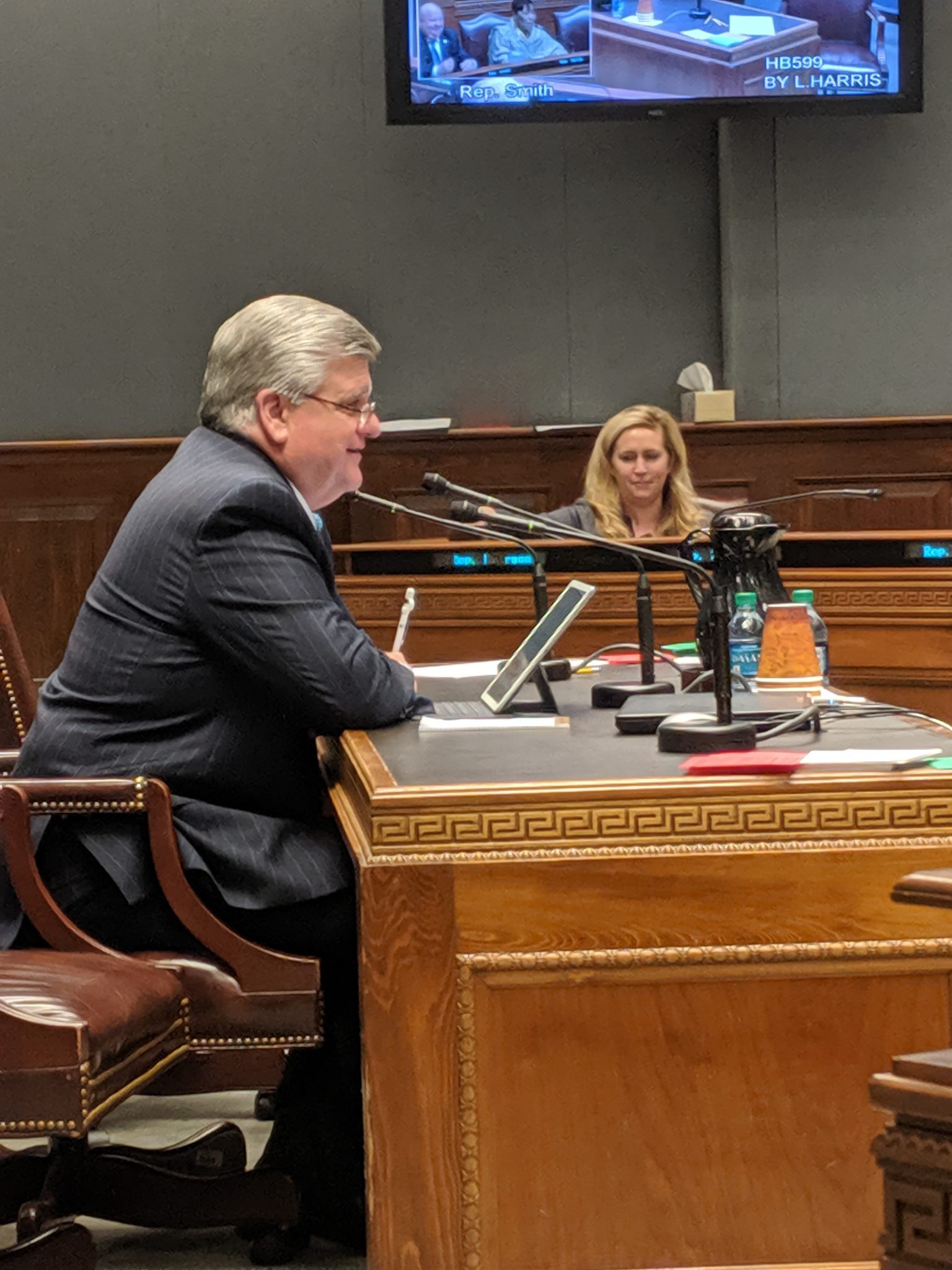

Tryfon Boukouvidis / LSU Manship School News Service | Rep. Lance Harris, R-Alexandria, presents his proposal before the House Appropriations Committee on Monday to phase out the extra 0.45 of a cent of the state sales tax that the Legislature extended last year.

House committee advances sales tax phase out

previous post